Life Capital Asset Planning

LIFE Capital Asset Planning

A digital solution to efficiently and accurately manage your capital asset plans

Optimize Capital Asset Planning

The LIFE Capital Asset Planning solution, a pivotal component of the SEAP (Smart Energy Asset Performance) platform, redefines capital asset planning through its innovative use of integrated Google spreadsheets and online detailed financial analysis tools.

This application empowers businesses to make informed decisions about equipment and system upgrades, focusing on maximizing value and enhancing operational efficiency. Users can effortlessly upload Excel spreadsheets to complement Google Sheets data, ensuring flexibility and accessibility in managing financial data. With LIFE, the process of evaluating the financial implications of replacing assets becomes not only straightforward but also deeply insightful, providing a clear picture of potential returns and savings.

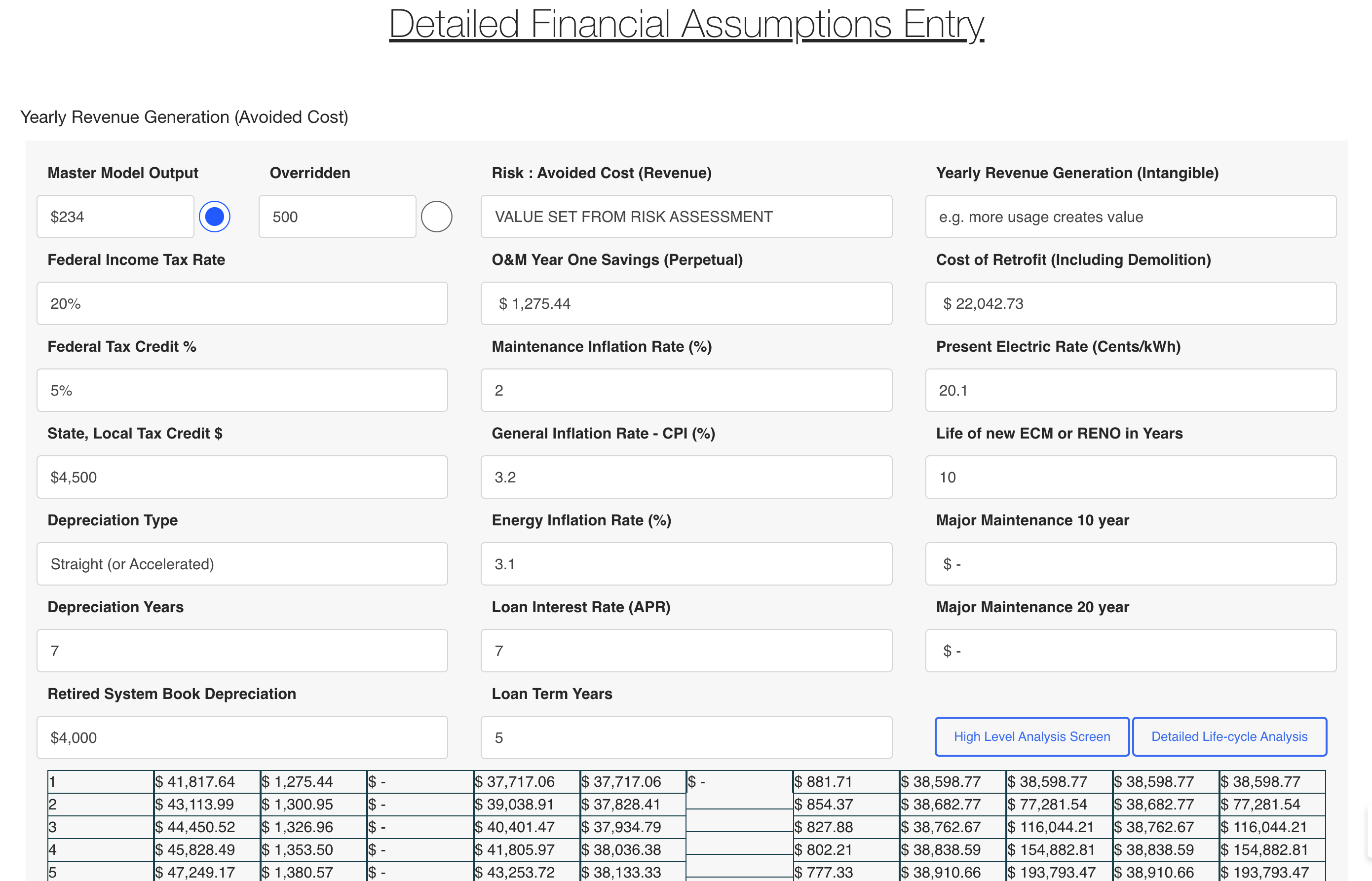

Detailed Assumptions for Precise Forecasting

The LIFE Capital Asset Planning prompts users to input detailed financial assumptions, such as yearly revenue generation from avoided costs, federal income tax rates, and the cost of retrofit projects, including demolition. LIFE's meticulous approach to data entry, exemplified by the ability to override master model outputs and input specific values for risk assessments, enables precise forecasting. This level of detail supports users in making well-informed decisions, calculating the tangible and intangible benefits of asset upgrades, and assessing the overall impact on their business's bottom line.

Streamlined Financial Analysis with Custom Templates

LIFE stands out by offering customizable templates for financial analysis, allowing users to quickly adapt and reuse established models for their specific needs. This feature significantly reduces the time and effort required to start a new analysis, ensuring consistency and reliability across assessments. Users are guided through detailed financial assumptions entry, including potential revenue generation, cost savings, and tax implications. This structured approach ensures that all relevant financial metrics are considered, from federal income tax rates to maintenance inflation rates, presenting a comprehensive view of the financial landscape for asset management.

Enhanced Decision-Making with Advanced Analytics

LIFE Capital Asset Planning leverages advanced analytics to provide users with a deep dive into the financial viability of capital investments. By analyzing data such as the present electric rate, depreciation type, and loan interest rates, businesses can forecast the long-term benefits and costs of their investments. The application also considers various tax credits, maintenance costs, and inflation rates, offering a robust framework for evaluating the life cycle of new equipment or renovations. With LIFE, businesses gain access to a powerful tool for strategic planning, ensuring that every capital investment is backed by detailed financial analysis and aligned with the company's growth objectives. Through the LIFE capital asset planning application within SEAP, businesses are equipped with a sophisticated platform for capital asset planning that combines ease of use with deep financial insights. This approach not only streamlines the decision-making process but also empowers businesses to invest confidently in their future, securing sustainable growth and operational efficiency.